Get the free grf form

Show details

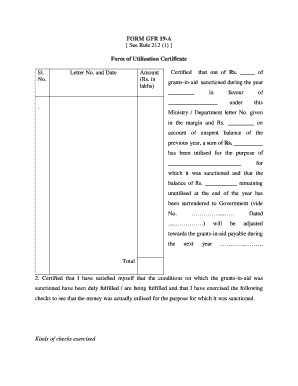

GFR 19-A (See Rule 212 (1)) Form of Utilization Certificate S. No. Letter No. and date Amount Total: Certified that out of Rs. of grants-in-aid sanctioned during the year in favor of under the USSR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your grf form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grf form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing grf form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit grf online form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out grf form

How to fill out the GRF form:

01

Start by carefully reading the instructions provided with the form. This will help you understand the purpose of the form and the information required.

02

Gather all the necessary documents and information needed to complete the form, such as personal identification details, relevant financial information, and any supporting documents required.

03

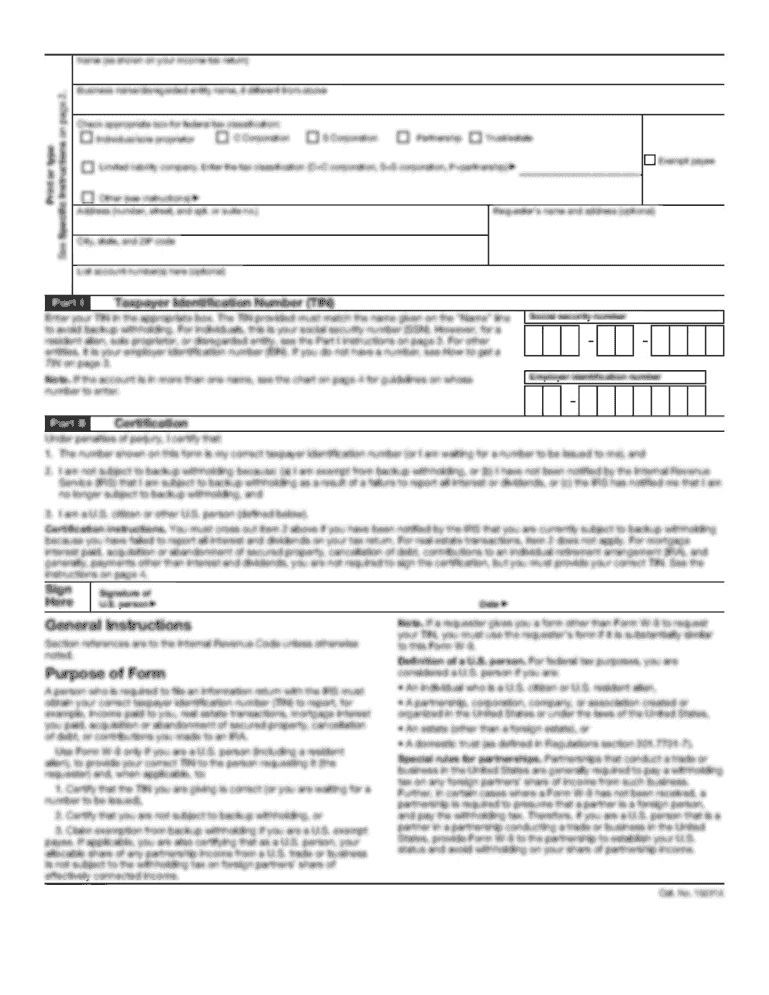

Begin filling out the form by entering your personal information in the designated fields. This may include your full name, address, contact information, social security number, or any other relevant identification details.

04

Follow the instructions provided for each section of the form and provide accurate information. Double-check the accuracy of your entries, as any mistakes or omissions could lead to delays or rejection of the form.

05

If the form requires you to provide financial or employment information, fill out the relevant sections with accurate details. This may include current or previous income, assets, liabilities, or employment history.

06

Pay attention to any additional sections or special instructions mentioned in the form. Some forms may require you to provide additional details or signatures in specific sections.

07

Once you have completed filling out the form, review it carefully to ensure all the necessary information has been provided and is accurate. Make any necessary corrections or additions before submitting the form.

08

Sign and date the form in the designated area, as required. Some forms may require additional witnesses or notarization, so be sure to follow all instructions provided.

09

Keep a copy of the filled-out form for your records before submitting it as per the specified instructions. It's always recommended to retain a copy for future reference.

Who needs GRF form:

01

Individuals or businesses seeking to participate in a specific program or obtain certain benefits may be required to fill out a GRF (General Request Form) as part of the application process.

02

The GRF form can be required for various purposes, such as applying for government grants, financial assistance, permits, licenses, or participating in specific initiatives.

03

The specific need for the GRF form may vary depending on the program, organization, or government entity requesting it. It is essential to consult the instructions or requirements provided by the relevant authority to determine if you need to fill out the GRF form.

Video instructions and help with filling out and completing grf form

Instructions and Help about grf form

Fill form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is grf form?

GRF Form stands for Goods and Services Tax (GST) Return Filing Form. It is a form used by businesses to file their quarterly GST returns. This form is used to declare the total sales and purchases made during the quarter, the total GST collected, and the total GST paid. The GST department also uses this form to assess the overall tax liability of the business.

Who is required to file grf form?

GRF form is required to be filed by all employers who have more than one employee, and who have paid wages of more than $1500 in the past 12 months.

What is the purpose of grf form?

The GRF form is a document used by the Internal Revenue Service (IRS) to collect taxpayer information. It is used to report information related to the filing of a return, receive payments or refunds, and make inquiries or adjustments to a taxpayer's account.

How to fill out grf form?

To fill out the GRF (Government Revenue Form) correctly, follow these steps:

1. Obtain the GRF form: You can find the form on the official government website or request it from the relevant government agency.

2. Read the instructions: Go through the instructions accompanying the form carefully to understand the requirements and any specific guidelines for filling out the form.

3. Provide personal information: Start by entering your personal details, such as your name, contact information, and taxpayer identification number as required. Ensure accuracy and legibility in providing this information.

4. Report income: Proceed to report your income as per the instructions provided. This may include wages, salaries, self-employment earnings, dividends, interests, rental income, or any other applicable sources of income. Make sure to include all relevant income and provide accurate figures.

5. Deduct allowable expenses: If the form requires you to deduct any allowable expenses, make sure to do so accurately. These could include business expenses, rental expenses, or any other expenses that can be deducted as per the tax regulations.

6. Calculate taxable income: Use the provided sections or worksheets to calculate your taxable income based on the information you entered. Double-check your calculations to ensure accuracy.

7. Compute tax liability: Use the tax tables or calculation methods specified in the form's instructions to determine your tax liability. Pay attention to any additional forms or schedules required for specific types of income.

8. Complete additional sections: Some forms may have additional sections or schedules that need to be filled out based on your specific circumstances. Ensure you complete these sections accurately.

9. Attach supporting documents: If required, attach any supporting documents, such as W-2 forms, 1099 forms, receipts, or other relevant documents, as specified by the form's instructions. Make sure to keep copies of these documents for your records.

10. Sign and submit: Once you have filled out the entire form and reviewed it for accuracy, sign and date the form as required. Send the completed form to the appropriate government agency using the provided instructions, be it through mail, electronically, or any other specified method.

Remember to keep copies of the filled-out form, attachments, and any other relevant documents for future reference or auditing purposes.

How can I send grf form to be eSigned by others?

Once your grf online form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out grf online form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign grf certificate and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete gfr19 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your grf form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your grf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grf Online Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.